Reimbursement of Children Education Allowance and Hostel Subsidy – CG Employees Should Know the Key Points

One of the Most Important Allowance for the Wards of Central Government Employees

Every Central Government Employee Should Know the Procedure of Reimbursement of Children Education Allowance and Hostel Subsidy.

Reimbursement of CEA and Hostel Subsidy shall be applicable for children from class nursery to twelfth, including classes eleventh and twelfth held by Junior Colleges or schools affiliated to Universities or Boards of Education. CEA is allowed in case of children studying through “Correspondence or Distance Learning”.

|

Reimbursement of CEA and Hostel Subsidy shall be applicable for children from class nursery to twelfth, including classes eleventh and twelfth held by Junior Colleges or schools affiliated to Universities or Boards of Education. CEA is allowed in case of children studying through “Correspondence or Distance Learning”.

|

|

The reimbursement of Children Education Allowance and Hostel subsidy can be claimed only for the two eldest surviving children with the exception that in case the second child birth results in twins/multiple birth.

|

|

In case of failure of sterilization operation, the CEA/Hostel Subsidy would be admissible in respect of children born out of the first instance of such failure beyond the usual two children norm.

|

|

The amount for reimbursement of Children Education allowance will be Rs.2250/- per month (fixed) per child.

|

|

This amount of Rs.2250/- is fixed irrespective of the actual expenses incurred by the Govt. Servant.

|

|

The amount of ceiling of hostel subsidy is Rs.6750/- pm.

|

|

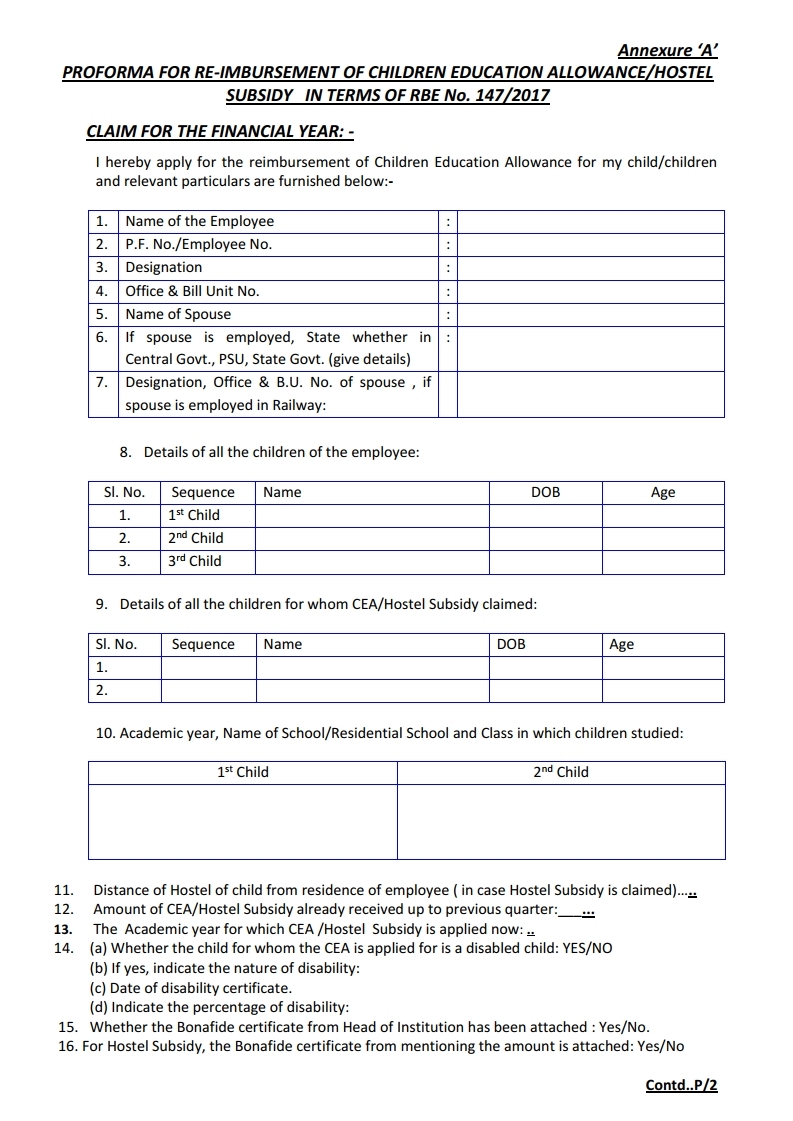

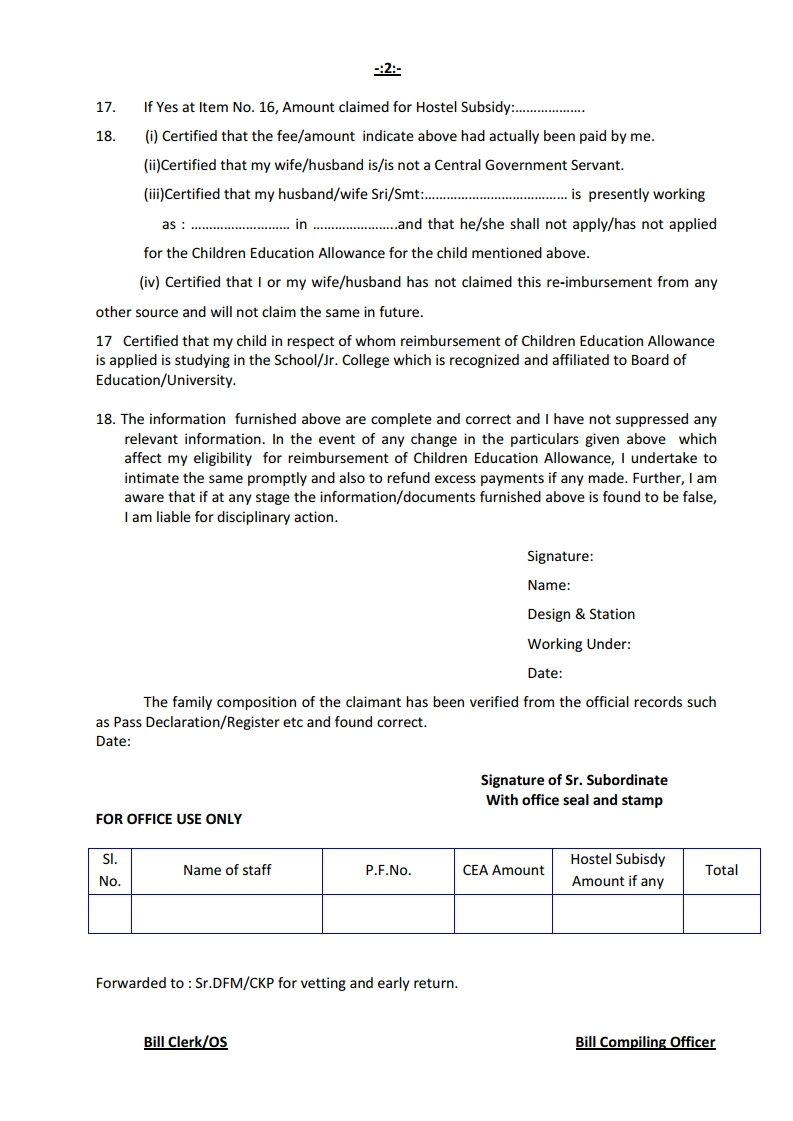

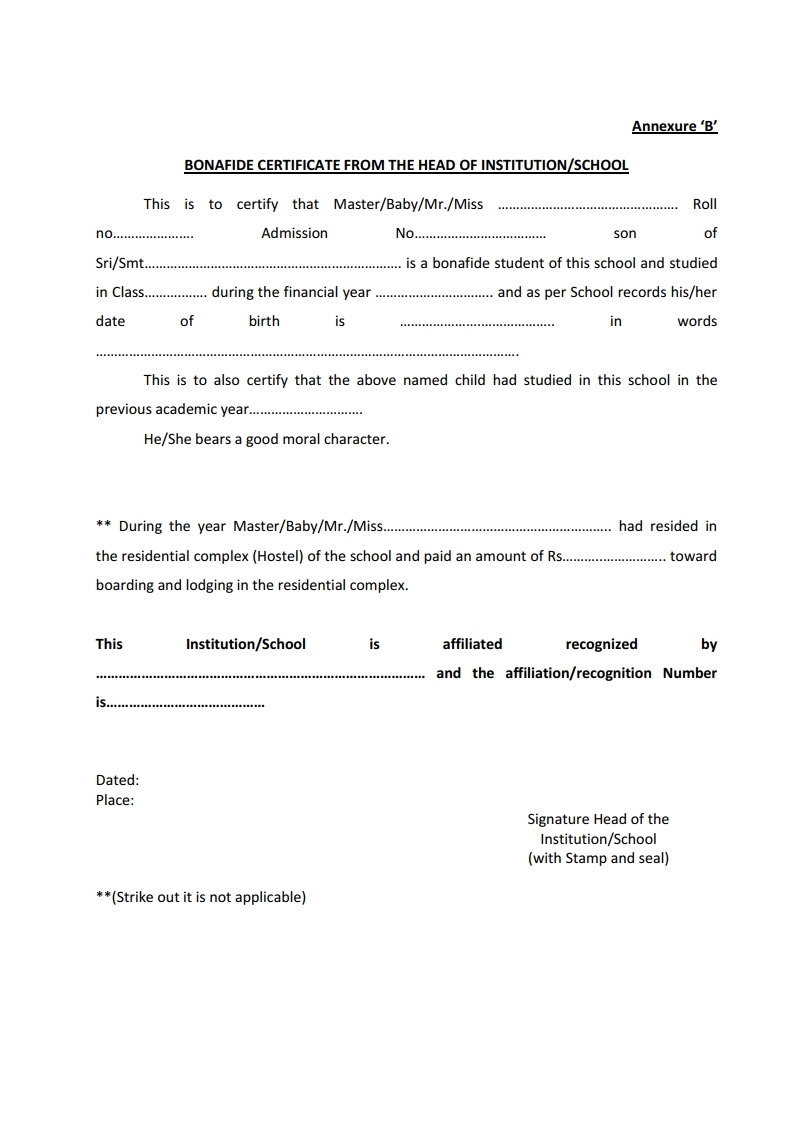

The Govt. servant should produce a certificate issued by the Head of the Institution for the period/year for which claim has been preferred. The certificate should confirm that the child studied in the school during the previous academic year.

|

|

In case such certificate can not be obtained, self- attested copy of the report card or self attested fee receipt(s){including e-receipt(s)} confirming or indicating that the fee deposited for the entire academic year can be produced as a supporting document to claim CEA.

|

|

The period/year means academic year i.e. twelve months of complete academic session.

|

|

The reimbursement of Children Education Allowance for Divyaang children of government employees shall be payable at double the normal rates of CEA prescribed above in clause (b) i.e. Rs.4500/- per month (fixed)

|

|

In case both the spouses are Government servants, only one of them can avail reimbursement under Children Education Allowance and Hostel Subsidy.

|

|

The above rates/ceiling would be automatically raised by 25% every time the Dearness Allowance on the revised pay structure goes up by 50%.

|

|

The Hostel Subsidy and Children Education Allowance can be claimed

concurrently. |

|

The reimbursement of CEA and Hostel Subsidy will be done just once in a financial year after completion of the financial year.

|

|

Hostel subsidy is applicable only in respect of the child studying in a residential educational institution located at least 50 kilometers from the residence of the Government servant.

|

|

Even if a child fails in a particular class, the reimbursement of Children Education Allowance and Hostel Subsidy shall not he stopped.

|

|

In case of retirement, discharge, dismissal or removal from service, CEA and Hostel Subsidy shall be admissible till the end of the academic year

|

from Blogger http://www.systempost.in/2019/06/reimbursement-of-children-education.html